Alternative asset classes have delivered strong performance over the past decade. However, many investors face significant barriers to accessing these opportunities. Traditional closed-end funds in alternative investments often require high minimum commitments and involve long lock-up periods. In contrast, Listed Alternatives offer a more accessible pathway, providing daily liquidity and direct exposure to Private Equity, Private Debt, and Infrastructure asset classes.

The following primer provides an overview to Listed Alternatives:

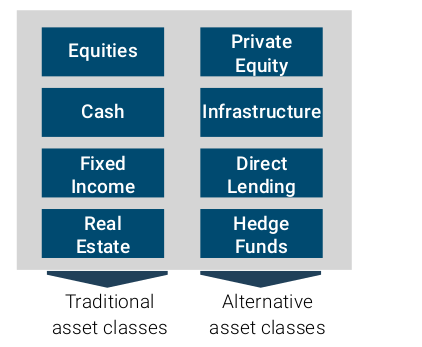

Alternative Asset Classes are increasingly gaining Importance in Investment Portfolios.

Strategic asset allocation is encountering significant challenges. The increased correlation across international financial markets has made it difficult to achieve efficient diversification through traditional asset classes alone. In this context, alternative investments are gaining greater prominence. Over the long term, asset classes such as private equity, infrastructure, and private debt stand out for their unique risk and return characteristics, which are not replicable by other asset classes. Consequently, alternative asset classes have become a vital component of strategic asset allocation in institutional portfolios.

The current interest rate environment has further accelerated the shift towards alternative investments. Infrastructure, in particular, has emerged as a compelling alternative to traditional real estate, offering distinct advantages. Meanwhile, private debt has evolved into a standalone asset class, complementing traditional fixed-income investments. Lastly, private equity is experiencing a resurgence, providing investors with access to untapped growth markets and cutting-edge technologies.

This primer highlights Listed Alternatives as an efficient gateway to alternative asset classes, including private equity, infrastructure, and private debt.

2. Why invest in Alternative Investments?

Alternative Investments are particulary suitable for Participating in Mega Trends.

In the long term, alternative investments are defined by their unique risk and return characteristics, making them a vital component of strategic asset allocation. Their diversification benefits are particularly significant, enabling more resilient and balanced portfolios. From a financial market perspective, alternative asset classes broaden the investment horizon and improve risk-adjusted returns in diversified portfolios.Beyond the financial-market theoretical arguments, what else supports investing in alternative asset classes? Investments are inherently tied to decisions about specific technologies. For instance, an investor purchasing shares in an automaker is inherently making a decision to align with the associated technologies and innovations.

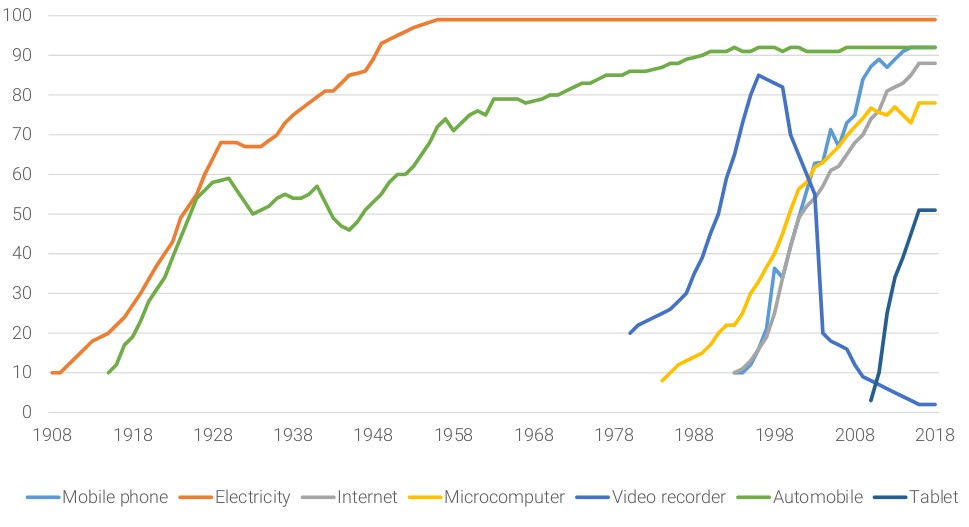

Source: Comin and Hobijn (2004) and others, LPX AG

Technology Investing

In this context, an investor in alternative investments is inherently a technology investor. To better understand the value drivers of alternative investments, it is essential to delve deeper into the concept of technology. Broadly, technologies can be categorized into the following three types:

- Basic technologies are the foundation for the growth and success of other innovations, forming the backbone of every modern economy. Companies in this category are characterized by relatively stable returns and lower technological risk.

- Growth technologies are already established and exhibit high growth rates. These companies are often privately held, medium-sized enterprises. Access to such companies is typically facilitated through private equity funds, often in the context of growth financing or succession planning (e.g., buyouts).

- New technologies hold significant growth potential if they succeed in capturing their target markets. Companies in this category are frequently supported by venture capital funds, either through equity or debt financing.

selected technologies in the US over the period 1908 to 2018. The following main statements can be seen from the figure:

- The rate of adoption of new technologies has steadily increased over time

- Few technologies achieve an adoption rate of 100% and are establishing themselves as a base technology

- Today’s basic technologies used to be all new technologies that had to assert themselves and establish themselves

How can an Investor gain access to a diversified Technologie Portfolio?

From an investor’s perspective, participating in the growth of new technologies is highly desirable. To balance and diversify investment risks, it is equally prudent to invest in well-established basic technologies. The private equity asset class offers unique access to innovative new technologies, enabling investors to benefit from future growth potential. Similarly, private debt also provides exposure to these technologies, differing only in the financing structure—debt versus equity.

In contrast, the infrastructure asset class grants access to core technologies that serve as the foundation for the development of new innovations. These technologies are often found in network industries such as energy, transport, water, and communications. Historically, these strategic industries were predominantly state-owned, but global privatization efforts have now opened up opportunities for a wider range of investors to participate.

Basically, there are two ways to invest in Alternatives Asset Class: Closed Funds or Listed Alternatives.

Alternative asset classes can be accessed through two primary paths, as outlined schematically in Figure 4. The first path involves closed-end funds, which are investment vehicles with a fixed maturity. These funds are fundamentally illiquid, with trading typically limited to the secondary market. They also require high minimum investments that must be committed over a predetermined period. Capital is provided by limited partners (LPs), usually large institutional investors such as pension funds or insurance companies.The second path is through exchange-traded investment vehicles, which represent portfolios of non-exchange-traded companies or diversified fund portfolios. In the case of the infrastructure asset class, for instance, these vehicles often represent operators or concessionaires of core infrastructure facilities. Unlike closed-end funds, which are largely exclusive to institutional investors, exchange-traded options provide a broader investor base with access to alternative asset classes, offering enhanced liquidity and accessibility.

Closed End Fund

- Fixed term

- High minimum investment

- Commitments are called up and invested over a certain period of time

- Slow build-up of the investment portfolio (see J-Curve effect)

- Only tradable via the secondary market

Listed Alternatives

- Indefinite duration («Evergreen»)

- No minimum investment

- Direct access to a diversified investment portfolio and therefore no J-Curve effect

- Daily liquidity due to stock market listing

LISTED ALTERNATIVES PROVIDE EFFICIENT ACCESS TO ALTERNATIVE ASSET CLASSES

Listed Alternatives represent an intriguing niche within the equity universe. However, there is currently no standardized industry classification to accurately identify and categorize a representative universe of companies operating in this space. Additionally, no universally accepted definitions exist for the Private Equity, Infrastructure, and Private Debt asset classes.

As a leading research house specializing in Listed Alternatives, LPX AG has wwweloped a proprietary industry classification scheme to address this gap. This classification is essential for creating representative performance benchmarks and ensuring the accurate evaluation of companies in the Listed Alternatives sector.

The selection of securities is guided by a rigorous research process that identifies and classifies relevant companies, as illustrated in Figure 5.

Establishing a standardized classification and determining the relevant base universe are critical steps for enabling innovative investment strategies in Listed Alternatives.

BENCHMARKING

Performance benchmarks are an important research tool to measure and compare asset classes and their sub segments in terms of their risk and return characteristics. The largest and most liquid companies in the base universe are used to construct representative performance benchmarks. The individual companies in the index are weighted according to their market capitalization, with a weight limit of 10% for each company to ensure sufficient diversification within each index.

For inclusion in the Listed Alternative base universe, the following criteria must be fulfilled:

Listed Private Equity

- Provision of equity capital

- At least 50% of the total assets must be provided as equity capital to unlisted companies

- The company must pursue an active exit strategy with the aim of achieving capital gains on the portfolio investments

Listed Debt

- Provision of debt capital

- At least 50% of the total assets must be provided as debt to unlisted companies

- Categorization and valuation of the entire private debt portfolio

Listed Infrastructure

- Company must own and/or operate a basic infrastructure facility under a long-term concession basis

- At least 50% of revenues must be attributable to the infrastructure network operation

On this basis, LPX AG has established index families, which can be used as standard benchmarks for alternative asset classes.

LPX

LISTED PRIVATE EQUITY

INDEX SERIES

NMX

INFRASTRUCTURE

INDEX SERIES

DLX

DIRECT LENDING

INDEX SERIES

LISTED ALTERNATIVE BENCHMARKS

LPX AG’s Listed Alternative index series are widely used as references and benchmarks for alternative asset classes across various sectors:

- Regulation: EIOPA incorporates the LPX indices within the framework of Solvency II, while FINMA applies them in the context of Swiss Solvency regulations.

- Pension Funds: LPX indices serve as representative performance benchmarks for risk management purposes.

- Insurance: The indices are integral to risk controlling strategies within the insurance sector.

- LPE Companies: Listed Private Equity (LPE) companies utilize the LPX indices as their primary peer benchmark.

- Investment Banks: LPX indices are the most widely recognized benchmarks for liquid private equity investment products.

- Academia: LPX indices form the basis for numerous empirical studies on alternative asset classes.

Listed Alternatives offer attractive Risk and Return Characteristics.

LPX Group is the leading provider of Listed Alternative Performance Benchmarks. Since the underlying index constituents are listed globally on regulated stock exchanges, LPX Group indices are calculated in accordance with generally accepted industry standards in the field of equity indexing. By being based on market prices, the performance benchmarks allow for direct comparisons with other indices or benchmarks. These benchmarks are essential for empirically validating the investment characteristics attributed to alternative asset classes and are widely regarded as standard performance benchmarks.

The following benchmarks are used to measure the performance characteristics of alternative asset classes:

-

LPX50 Listed Private Equity Index

The LPX50 Index represents the global performance of the 50 most highly capitalized and liquid Listed Private Equity companies. The index is diversified across regions, private equity investment styles, financing types, and vintages.

-

DLX Direct Lending Index

The DLX Index reflects the performance of the 35 most highly capitalized Direct Lending companies. It features a broadly diversified private debt portfolio, primarily focused on middle-market companies.

-

NMX30 Infrastructure Global

The NMX30 Infrastructure Global Index captures the global performance of the infrastructure asset class and includes the 30 most highly capitalized and liquid basic Infrastructure companies. The index is diversified across regions, currencies, and infrastructure sectors. Basic Infrastructure companies are defined as entities that own and/or operate core infrastructure network facilities in the energy, transport, water, and communication (ICT) sectors.

Basis date

PRIVATE EQUITY

LISTED DEBT

LISTED

INFRASTRUCTURE

Performance over 10 years

Basis date

Alternative asset classes are becoming increasingly important in strategic asset allocation, primarily due to the low interest rate environment and the growing need to broaden the investment opportunity set. These asset classes offer attractive risk and return characteristics alongside significant diversification benefits.Listed Alternatives provide efficient access to alternative asset classes with daily liquidity. They have empirically demonstrated long-term attractive risk and return profiles, supported by representative benchmarks for private equity, infrastructure, and private debt.

Key Benefits of Listed Alternatives:

- Efficient access to alternative asset classes with daily liquidity

- Long-term attractive risk and return characteristics

- Participation in “Mega Trends” and the entire spectrum of technologies

- Direct access to a diversified portfolio of private equity, private debt, and infrastructure investments

- No fixed terms or minimum investment requirements

NUMBER OF COMPANIES

> 500

MARKET CAP EUR BILLIONS

> 4.500