Performance over 10 years

Basis date

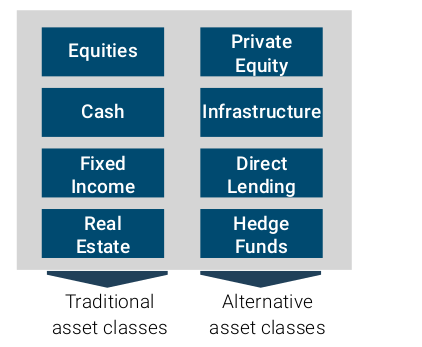

Alternative asset classes have achieved attractive performance over the past 10 years. However, access to alternative asset classes is unfeasible for many investors. Traditional closed-end funds in the area of alternative investments are characterized by high minimum investments and long lock-up periods. In contrast, Listed Alternatives provide access to alternative asset classes with daily liquidity and direct exposure to the Private Equity, Private Debt and Infrastructure asset classes.

The following primer provides an overview to Listed Alternatives:

ALTERNATIVE ASSET CLASSES ARE INCREASINGLY GAINING IMPORTANCE IN INVESTMENT PORTFOLIOS.

Strategic asset allocation is facing major challenges. Due to the increased correlation on the international financial markets, the efficient diversification of an investment portfolio can hardly be achieved through traditional asset classes. Against this backdrop, alternative investments are becoming increasingly important. In the long term, these asset classes, such as private equity, infrastructure, private debt, etc., are characterized in particular by having risk and return characteristics that are not replicable by other asset classes. In institutional portfolios, alternative asset classes have therefore long been an important component of strategic asset allocation.

The current interest rate environment has further strengthened the trend towards alternative asset classes. As a result, investors discovered the infrastructure asset class which has numerous advantages compared to traditional real estate investments. Private debt, as a supplement to traditional fixed-income investments, has emerged as a separate asset class. Last but not least, private equity is also experiencing a renaissance, giving investors access to untapped growth markets and future technologies.

The article focuses on Listed Alternatives – an efficient way to access alternative asset classes such as private equity, infrastructure or private debt.

2. WHY INVEST IN ALTERNATIVE INVESTMENTS?

ALTERNATIVE INVESTMENTS ARE PARTICULARLY SUITABLE FOR PARTICIPATING IN MEGA TRENDS.

Alternative investments are characterized in the long run by having autonomous risk and return characteristics. Thus, they are an integral part of the strategic asset allocation, in particular due to the attributed diversification characteristics. From a financial market perspective, alternative asset classes extend the investment horizon and enhance the risk-adjusted return in a diversified investment portfolio. What else speaks – apart from financial-market-theoretical arguments – for an investment in alternative asset classes? Investments are always linked to a decision in a specific technology. An investor, for example, who buys shares of an automaker, thus automatically decides on the associated

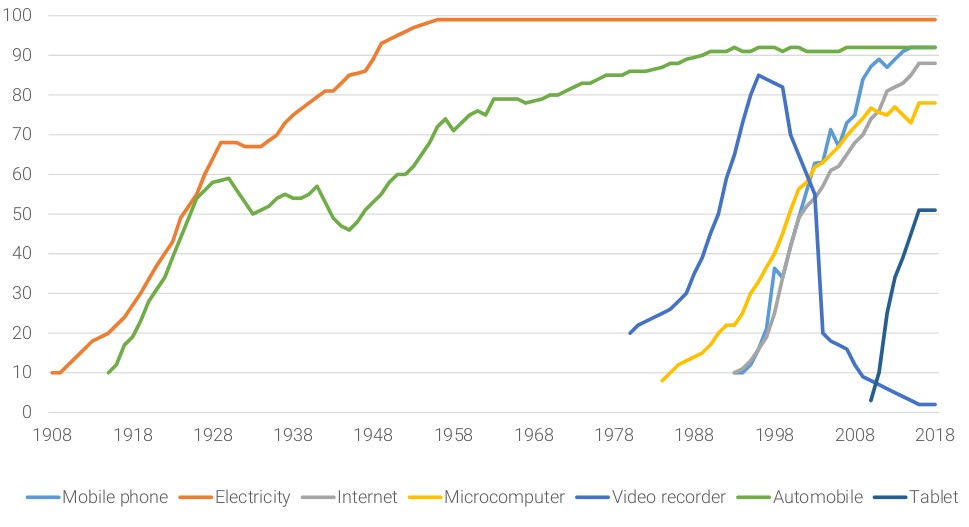

Source: Comin and Hobijn (2004) and others, LPX AG

TECHNOLOGY INVESTING

An investor in alternative investments is thus always a technology investor against this backdrop. In order to better understand the value drivers of alternative investments, it is necessary to elaborate on the concept of technology. Basically, technologies can be divided into the following three categories:

- Basic technologies are considered to be the foundation for the growth and success of other technologies and are the foundation of every modern economy. Companies in basic technologies are characterized by comparatively constant yields and low technological risk.

- Growth technologies have already established themselves and are showing high growth rates. Often these companies are private medium-sized companies. Access to these companies is possible through private equity funds, often in the context of growth or follow-up

financing (buyout). - New technologies have a high growth potential if they prevail in the relevant market. Companies in this area are often funded by venture capital funds (equity or debt).

selected technologies in the US over the period 1908 to 2018. The following main statements can be seen from the figure:

- The rate of adoption of new technologies has steadily increased over time

- Few technologies achieve an adoption rate of 100% and are establishing themselves as a base technology

- Today’s basic technologies used to be all new technologies that had to assert themselves and establish themselves

HOW CAN AN INVESTOR GAIN ACCESS TO A DIVERSIFIED TECHNOLOGY PORTFOLIO?

From the perspective of an investor, it is desirable to participate in the growth of new technologies. In order to diversify the investment risk, it makes sense to invest in well-established basic technologies.The private equity asset class provides access to new innovative technologies. An investor invests at a time when one can benefit from future growth. In a mirror image, the private debt asset class also provides access to new innovative technologies, as the asset class differs only in terms of the type of financing: Debt vs. Equity

In contrast, the infrastructure asset class provides access to core technologies that can be considered as the foundation for new technologies. These are network industries in the

energy, transport, water and communications sectors. Basic technologies are of strategic importance and were formerly almost exclusively state-owned. The worldwide wave of privatization has today made these companies accessible to a broad range of investors.

BASICALLY, THERE ARE TWO WAYS TO INVEST IN ALTERNATIVES ASSET CLASS: CLOSED FUNDS

OR LISTED ALTERNATIVES.

Alternative asset classes are accessible via two paths, as shown schematically in Figure 4. The first one is closed-end funds. This is an investment vehicle with a fixed maturity,

which is fundamentally illiquid and tradable only via the secondary market. In addition, they have a high minimum investment that must be invested over a set period of time.

Capital is provided by limited partners (LP). These are typically large institutional investors, such as pension funds or insurance companies. The second way is through exchange-traded investment vehicles that account for an investment portfolio in non-exchange traded companies or a diversified fund portfolio. The infrastructure asset class is the operator or concessionaire of a base infrastructure facility. Unlike closed-end funds, which are primarily reserved for institutional investors, the exchange offers a broader investor base access to alternative asset classes.

Closed End Fund

- Fixed term

- High minimum investment

- Commitments are called up and invested over a certain period of time

- Slow build-up of the investment portfolio (see J-Curve effect)

- Only tradable via the secondary market

Listed Alternatives

- Indefinite duration («Evergreen»)

- No minimum investment

- Direct access to a diversified investment portfolio and therefore no J-Curve effect

- Daily liquidity due to stock market listing

LISTED ALTERNATIVES PROVIDE EFFICIENT ACCESS TO ALTERNATIVE ASSET CLASSES

Listed Alternatives are an interesting niche within the equity universe. Interestingly, there is no standardized industry classification to identify and classify a representative universe of companies in the field of Listed Alternatives. Furthermore, there is no general definition available for the Private Equity, Infrastructure and Private Debt asset classes.

As a leading research house in the field of Listed Alternatives, LPX AG has established a proprietary industry classification scheme in the area of Listed Alternatives. The classification of Listed Alternatives is a prerequisite in order to provide representative performance benchmarks.

The selection of securities is based on a research process that identifies and classifies the relevant companies, as shown in Figure 5.

The determination of the relevant base universe and a standardized classification are key for the implementation of innovative investment strategies.

BENCHMARKING

Performance benchmarks are an important research tool to measure and compare asset classes and their sub segments in terms of their risk and return characteristics. The largest and most liquid companies in the base universe are used to construct representative performance benchmarks. The individual companies in the index are weighted according to their market capitalization, with a weight limit of 10% for each company to ensure sufficient diversification within each index.

For inclusion in the Listed Alternative base universe, the following criteria must be fulfilled:

Listed Private Equity

- Provision of equity capital

- At least 50% of the total assets must be provided as equity capital to unlisted companies

- The company must pursue an active exit strategy with the aim of achieving capital gains on the portfolio investments

Listed Debt

- Provision of debt capital

- At least 50% of the total assets must be provided as debt to unlisted companies

- Categorization and valuation of the entire private debt portfolio

Listed Infrastructure

- Company must own and/or operate a basic infrastructure facility under a long-term concession basis

- At least 50% of revenues must be attributable to the infrastructure network operation

On this basis, LPX AG has established index families, which can be used as standard benchmarks for alternative asset classes.

LPX

LISTED PRIVATE EQUITY

INDEX SERIES

NMX

INFRASTRUCTURE

INDEX SERIES

DLX

DIRECT LENDING

INDEX SERIES

LISTED ALTERNATIVE BENCHMARKS

LPX AG’s Listed Alternative index series are used as references and benchmarks for alternative asset classes:

- Regulation – EIOPA uses the LPX indices in the context of Solvency II; FINMA uses the indices in the context of Swiss Solvency

- Pension funds – The LPX indices are used as a representative performance benchmark in risk management

- Insurance – The LPX indices are used in risk controlling

- LPE companies – LPE companies use the LPX indices as their relevant peer benchmark

- Investment Banks: The LPX indices are the most widely used indices for liquid private equity investment products

- Academia – The LPX indices are used as the basis for a variety of empirical studies on alternative asset classes

LISTED ALTERNATIVES OFFER ATTRACTIVE RISK AND RETURN CHARACTERISTICS.

LPX Group is the leading provider of Listed Alternative Performance Benchmarks. Due to fact that the underlying index constituents are listed globally on regulated stock exchanges, the LPX Group indices are calculated in accordance to generally accepted industry standards in the field of equity indexing. As the performance benchmarks are based on market prices, a direct comparison with other indices or benchmarks is feasible. The performance benchmarks can be used to empirically validate the investment characteristics attributed to alternative asset classes and are considered as standard performance benchmarks.

The following benchmarks are used to measure the performance characteristics of alternative asset classes:

-

LPX50 Listed Private Equity Index

The LPX50 is designed to represent the global performance of the 50 most highly capitalized and liquid Listed Private Equity companies. The index is diversified across regions, private equity investment styles, financing styles and vintages.

-

DLX Direct Lending Index

The DLX Index is designed to represent the 25 most highly capitalized and Direct Lending companies. The DLX index is characterized by a broad diversified private debt portfolio in mainly middle market companies.

-

NMX30 Infrastructure Global

The NMX30 Infrastructure Global is designed to represent the global performance of the infrastructure asset class and comprises the 30 most highly capitalized and liquid basic Infrastructure companies. The index is diversified across regions, currencies and infrastructure sectors. Basic Infrastructure companies refer to companies with own and/or operate a core infrastructure network facility in the infrastructure sectors Energy, Transport, Water and Communication (ICT).

Basis date

PRIVATE EQUITY

LISTED DEBT

LISTED

INFRASTRUCTURE

Alternative asset classes are becoming increasingly important in strategic asset allocation. This is due to the low interest rate environment and hence the need for investors to extend the investment opportunity set. It can be shown that alternative asset classes exhibit attractive risk and return characteristics and high potential diversification benefits.

Listed Alternatives, which provide efficient access to alternative asset classes, have attractive risk and return characteristics in the long-run, which is supported empirically by the set of representative performance benchmarks for the private equity, infrastructure and private debt asset classes.

Listed alternatives offer in particular:

- Efficient access to alternative asset classes with daily liquidity

- Long-term attractive risk and return characteristics

- Participation in “Mega Trends“ and the entire spectrum of technologies

- Direct access to a diversified portfolio of alternative private equity, private debt and infrastructure investments

- No fixed term and no minimum investment

NUMBER OF COMPANIES

MARKET CAP EUR BILLIONS

LISTED PRIVATE EQUITY

LISTED DEBT

LISTED INFRASTRUCTURE